Arizona Contracting Sales Tax Flow Charts for 2015 March 17, 2015

Posted by carolhagen in Construction Industry.Tags: Arizona Construction Sales Tax, Arizona Sales Tax, AZ TPT, construction, contracting

2 comments

If you’re in construction and perform work in Arizona, the first few months of 2015 have been confusing when it comes to sales tax (know as Transaction Privilege Tax). The recent changes signed into law a few weeks ago by our governor is supposed to ease the burdens on reporting and clarify the rules for the contracting community. After attending a few presentations on the subject by the Construction Financial Management Association (CFMA) and the National Association of Women in Construction (NAWIC) it is abundantly clear that the construction industry needs help in understanding what is required.

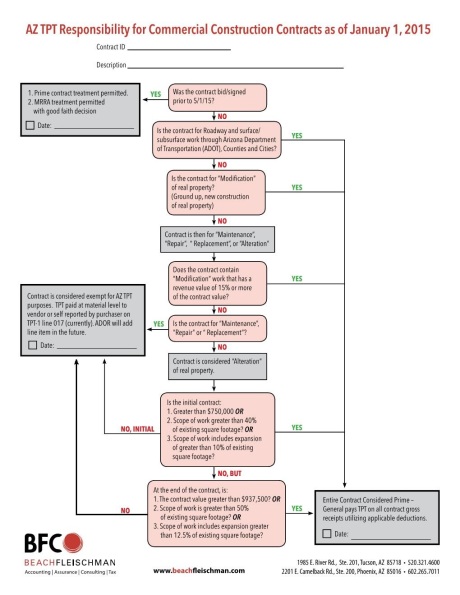

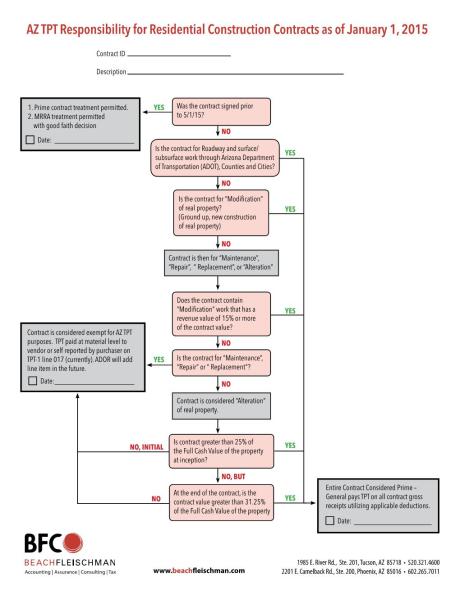

Many professional organizations are sponsoring lunch and learns, all day courses and everything in between. It was nice to stumble onto a resource handout that will ease some of the burden. As a tech geek, flow charts and decision trees clarify not only the best decision, but how you arrived at your choice. The flow charts below will guide you to the correct choice whether your construction project should be treated as a Prime Contract, Maintenance, Repair, Replacement or Alteration (MRRA), or your Contract is Exempt and sales tax is collected at material purchase or tracked by the purchaser and self reported. Thanks go out to BeachFleischman PC for creating these flow charts for both commercial and residential construction contracts.

File these with each project as a supporting document (in case of an audit from the Arizona Department of Revenue) and circle the Yes/No answers you used. Don’t forget to fill in the date in whichever grey box you end up in. To request a copy of these flow charts, please Email Me Your Contact Info

For advice on any tax interpretations, talk with your Certified Public Accountant or get connected with the CFMA to find a CPA that focuses on construction.

Arizona Sales Tax Prime Contracting Examples for 2015: How to Receive Automatic Updates December 1, 2014

Posted by carolhagen in construction accounting software.Tags: Arizona Construction Sales Tax, Arizona Sales Tax, Prime Contracting, Transaction Privilege Tax

add a comment

Marj Weber, Irontree Construction Inc introduces the AZ sales tax panel (left to right): Craig McPike, Snell & Wilmer; Christie Comanita, Arizona Dept. of Revenue; David James, FNF Construction at the CFMA luncheon

During the discussion, panelist Christie Comanita (ADOR) explained that the Transaction Privilege Tax Notice 14-1 is a living document and will have additional contracting examples and frequently asked questions added over time. The TPT Notice was chosen to expedite the dissemination of interpretations and streamlines the publication process. Unfortunately with the budget cuts at the ADOR, there is not an email notification option for changes to just this Tax Notice although changes will be published on the website and eventually distributed with all other TPT updates in the AZTaxes Newsletter.

As a construction technology provider and workflow process junkie, I’m here to empower you with a solution that delivers these updates to your inbox the same day that ADOR updates their website. It’s easy to do, takes less two minutes and is a must have for Construction CFOs, controllers, CPAs, and construction associations with business in Arizona.

Additional opportunities to learn about TPT:

December 5, 2014 Beach Fleishman – 7:30 – 12:00

(Annual construction conference – multiple topics with approx. 2 hours devoted to the new sales taxes)

Location: Lovitt and Touché, 1050 W. Washington #233, Tempe

Contact: Angel Wible, Beach Fleischman 602-265-7011

December 10, 2014 11:30-1:30pm Arizona Builders Alliance Office (Tucson)

For add’l info and to RSVP http://www.azbuilders.org/events/transaction-privilege-tax-reform/

December 11, 2014, 11:55 AM – 1:30 PM (Tucson) RSVP through the CFMA

Location: Sir Veza’s (Tucson Mall)

Contact: Krista Conway, Beach Fleischman KConway@BeachFleischman.com

December 11, 2014 ASCPA 11:30 registration: 12:00 webinar: ends 1:00

Location: ASCPA office, 4801 E Washington #225-B, Phoenix

Contact: Mary Holt 602-252-4144

Other things to look for in the upcoming months (from ADOR):

Ability to look up taxing jurisdiction and applicable tax rate by January 1, 2015

Bulk filing by jurisdiction by January 1, 2015

New joint tax application (JT-1) with jurisdiction address functionality: July 1, 2015

Enhanced AZTaxes.gov e-file system: October 1, 2015

New TPT form for filing monthly TPT returns which will allow taxpayers to report data by business location: October 1, 2015

Bulk filing capabilities for taxpayers to file by business location: October 1, 2015

An electronic license renewal process for all taxpayers, including non-program city taxpayers between October and December, 2015

Please share this with all your construction contacts doing business in Arizona. They’ll thank you for it!

To learn more about the CFMA and to get connected to more construction financial professionals, visit their website at http://www.cfma.org

If you are looking for technology solutions, we’re here to help. Hagen Business Systems, Inc. is focused on the construction industry moving contractors to digital, mobile and lean software solutions addressing the needs of operations with, mobile timekeeping, document management, equipment management and tracking, customer relationship management, construction project management, estimating and accounting. As a Viewpoint Business Development partner and Bluebeam Gold Partner we look for ways to streamline your processes and increase your productivity in the field and office.